ChartBrief 116 - Institutional investor capitulation

- Callum Thomas

- Jul 26, 2017

- 2 min read

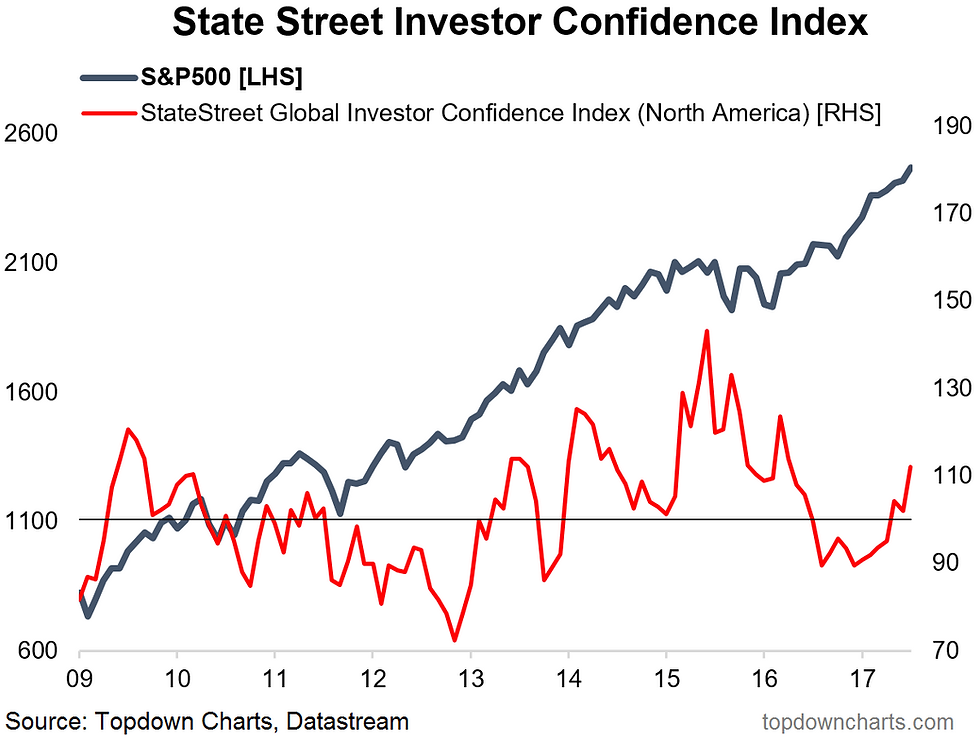

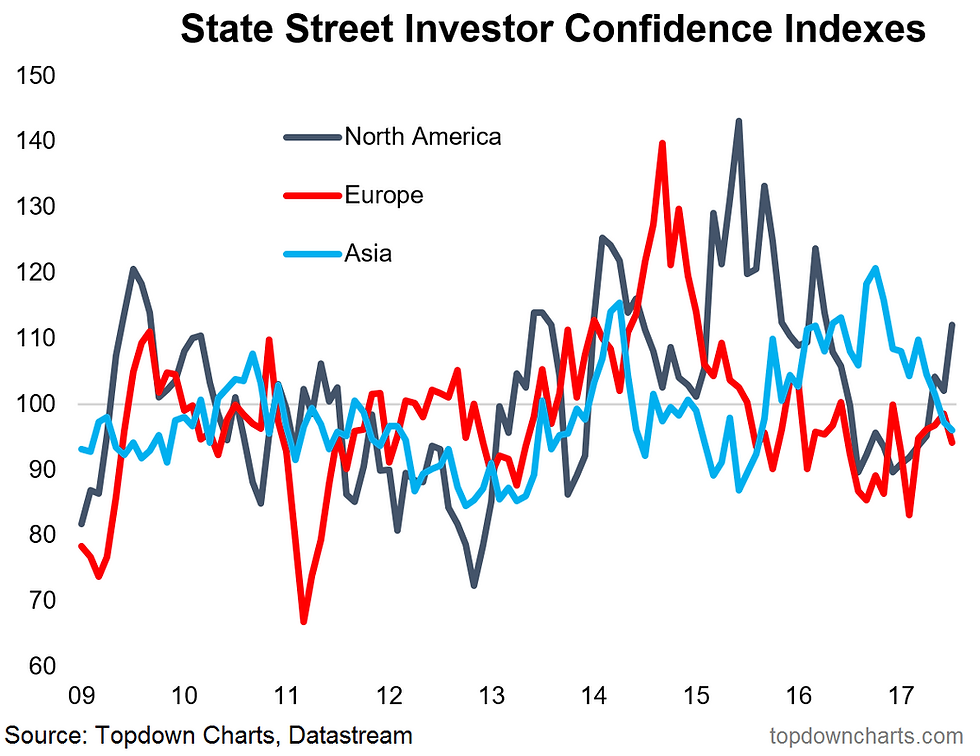

The latest State Street Investor Confidence Index data for July showed a distinct sense of upside capitulation (by North American institutional investors). The headline global index was up 7.9 points to 108.9 - this was driven purely by North American institutional investors with the North Am index up 10pts to 112.1 which offset declines in the European and Asian indexes. The second chart shows the divergence in sentiment between North American investors and the rest of the world. As a reminder, readings over 100 indicate institutional investors are increasing long-term equity allocations - the index is based on actual trades by State Street global custodian clients.

There is a clear sense of upside capitulation by North American investors; whether it's "TINA" (there is no alternative), or simply acknowledgement that the US earnings picture is improving, the global economy is looking better, and the Fed is expected to still go only gradually and carefully on monetary policy normalization. The issue of high valuations can be somewhat reconciled with these factors in that higher valuations also reflect higher investor confidence and expectations of stronger future earnings. Of course as expectations and sentiment heads higher it opens the possibility for disappointment.

North American institutional investors are the most confident since mid-2016 as a wave of upside capitulation buying takes hold. A focus on momentum and stronger fundamentals seem to be offsetting concerns about high valuations and the various background risks.

There seems to be waves of enthusiasm across the 3 major regions. For now European and Asian institutional investors have been reducing equity exposure in contrast to the more optimistic and bullish investor confidence seen in North America.

For institutional grade insights on the global economics and asset allocation, and some more good charts you may want to subscribe to the Weekly Macro Themes. Click through for a free trial.

Follow us on:

Comments