Charts of 2021: Honorable Mentions

- Callum Thomas

- Jan 2, 2022

- 2 min read

Last week I shared with you some of my Best Charts of 2021 (as well as my Worst Charts of 2021 and then also my favorites!) -- so this week I wanted to follow up with what I would say are the "honorable mention" charts of 2021...

These charts were worthy of mention but didn’t quite fit into any of the previous categories -- but were definitely worth including and highlighting both due to how they proved useful in the past year or so, but also in terms of the outlook into 2022.

These charts were featured in my just-released 2021 End of Year Special Report -- check it out (free download as a holiday treat!).

Enjoy, feel free to share, and be sure to let me know what you think in the comments...

1. Expect Higher Taxes: This chart arguably points to higher tax rates ahead given that government debt as a % of GDP has doubled over the past decade while effectively economy-wide tax-take has gone sideways.

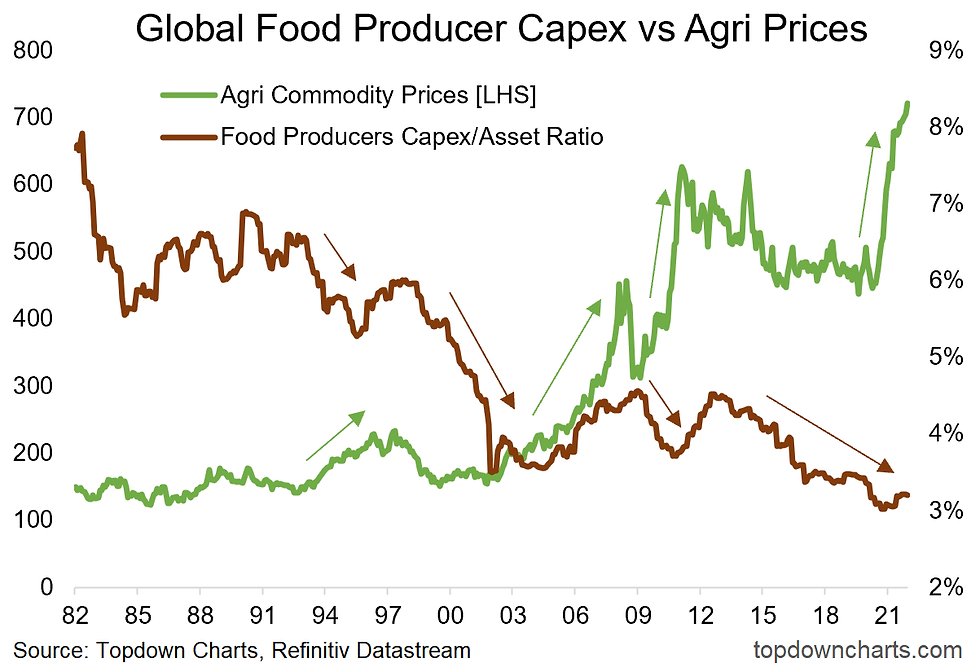

2. Global Food Crisis? Stagnant capex by food producers contributed to a perfect storm for food prices (along with actual storms, pandemic disruption, rising costs).

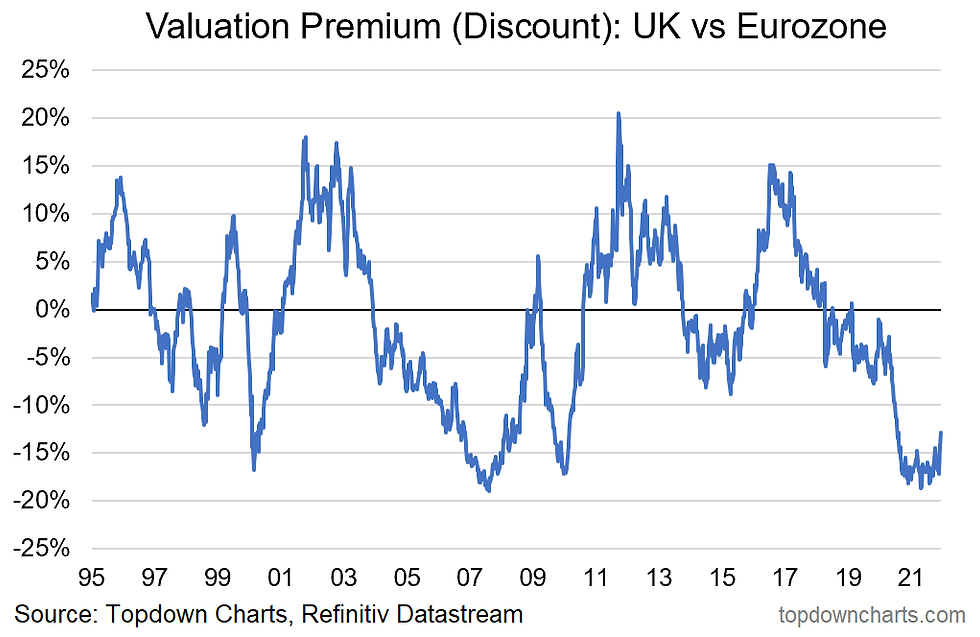

3. UK Equities: In the wake of Brexit & pandemic woes, UK equities moved to decade-low valuations vs their European peers. From crisis to opportunity?

>>> These charts were featured in our 2021 End of Year Special Report.

4. Global Shipping Capex: Shipping sector investment stagnated for a decade – contributing to the global supply chain chaos. Ironically it likely rebounds after banking windfall profits from the surge in freight rates.

5. Global vs US Earnings Cycles: A key driver of the long-term cycles of relative price performance of global vs US equities has been the cycles in relative earnings. That cycle will need to change for the price cycle to change.

6. Pandemic Progress: the global rollout of vaccines, rising immunity, societal adaptations, and therapeutics have helped result in a series of lower highs in deaths – I like the look of that trend. The light at the end of the tunnel, though flickering at times, does seem a little brighter now…

Thanks for reading!

This is an excerpt from my 2021 End of Year Special report - click through to download a free copy of the report.

Best regards

Callum Thomas

Head of Research and Founder of Topdown Charts

Follow us on:

Substack https://topdowncharts.substack.com/

Mình có lần lướt đọc mấy trao đổi trên mạng thì thấy có người nhắc tới trang chủ sc88 trong lúc câu chuyện đang nói dở, nên cũng mở ra xem thử cho biết. Mình không tìm hiểu sâu, chỉ xem qua trong thời gian ngắn để nhìn bố cục và cách sắp xếp nội dung tổng thể. Xem như vậy xong mình quay lại đọc tiếp các bình luận khác.

Mình có lần lướt đọc mấy bình luận trên mạng thì thấy nhắc tới Thương hiệu jun88, nên cũng tò mò vào xem thử cho biết. Mình chỉ xem qua trong thời gian ngắn, chủ yếu nhìn bố cục và cách trình bày, cảm giác khá gọn và dễ theo dõi.

Khi theo dõi một số bài chia sẻ về bóng đá, mình tình cờ thấy SOCOLIVE TV Ấn tượng ban đầu là giao diện rõ ràng, vào trực tiếp bóng đá socolive không bị rối, nội dung sắp xếp hợp lý nên xem cũng thoải mái.

Khi theo dõi một số bài chia sẻ về bóng đá, mình tình cờ thấy socolive tv Ấn tượng ban đầu là giao diện rõ ràng, vào trực tiếp bóng đá socolive không bị rối, nội dung sắp xếp hợp lý nên xem cũng khá thoải mái.

Mình tình cờ thấy new88 được nhắc đến trong một số cuộc trao đổi trên mạng nên cũng tò mò mở vào xem thử lúc rảnh. Mình không tìm hiểu quá sâu, chủ yếu dành thời gian lướt qua để quan sát bố cục tổng thể, cách sắp xếp nội dung và giao diện sử dụng. Cảm nhận ban đầu là mọi thứ được trình bày khá gọn gàng, các mục phân chia rõ ràng, nhìn vào không bị rối và dễ theo dõi thông tin cơ bản.